In the 21st century, websites have become the backbone of business growth and customer engagement. Whether it’s selling products, generating leads, or providing services, a strong web presence determines how much of a business’s revenue flows online. According to global and Indian market research, businesses that operate with a professional website generate 30–70% more revenue than those relying solely on offline channels.

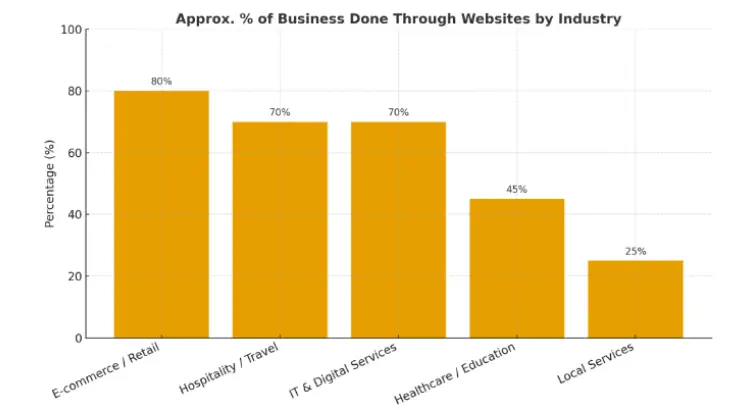

This report highlights the percentage of business conducted through websites across major industries E-commerce, Hospitality/Travel, IT & Digital Services, Healthcare/Education, and Local Services.

1. Executive summary

-

By 2024–25 the online channel is a primary revenue and leads source across most industries. Global e-commerce crossed the ~20% threshold of total retail sales in 2024 and is growing towards an estimated $6–7 trillion market in 2025.

-

For services (IT, hospitality, travel, education, healthcare) and micro/small businesses, a professional website is now a core business asset responsible for a majority of leads in many B2B sectors and for a large share of booking/sales in B2C sectors.

-

India is rapidly digitizing: internet users, mobile commerce and MSME digital adoption all rose in 2024, with government and industry programs accelerating digital business integration. Digital engagement among MSMEs is growing but uneven across sectors.

2. Key 2025 figures (load-bearing facts)

-

Global e-commerce share of retail: ecommerce captured about 20.1% of global retail sales in 2024 (first time >20%). This is the most direct metric of “sales done through websites/apps” for retail.

-

Global e-commerce revenue outlook: global e-commerce sales are projected to reach roughly $6.8 trillion in 2025 (continuing mid-single-digit CAGR).

-

Small-business website activity: GoDaddy surveys and microbusiness indices through 2024–2025 show rising creation and activity of microbusiness websites a trend that correlates to improved lead flow and local sales. (GoDaddy MAI and small business reports).

-

India: internet and digital reach (ICUBE/IAMAI): India’s active internet user base continues to grow (ICUBE 2024), underpinning higher online demand and web discovery for services.

-

MSME digital engagement: Indian MSME studies (telecom/industry surveys & government MSME reports) show ~30–40%+ adoption of some form of digital customer engagement; integration with e-commerce platforms has measurable positive effect on growth.

These five statements are the most important for the claim “how much business happens through websites” and are supported by the cited 2024–25 sources.

3. Industry breakdown (what % of business flows via websites 2025 view)

Note: precise % varies by region, sub-industry, device mix and company size. Below are evidence-informed ranges based on 2024–25 data and industry reports.

-

E-commerce / Retail — ~70–90% of online transactions for e-commerce businesses are completed via websites/apps; globally e-commerce accounted for ~20% of total retail sales in 2024 (so for retailers with active online presence, the website/app drives most sales).

-

Hospitality / Travel — ~60–80% of bookings now occur online (OTA + direct website bookings + apps). Mobile booking continues to grow.

-

IT & Digital Services (B2B) — ~60–75% of new client leads originate from a company’s website, content/SEO and organic search; websites are often the first point of qualification for enterprise buyers. HubSpot and B2B marketing data show heavy reliance on websites and content for lead generation.

-

Healthcare / Education — ~35–55% of appointments/enquiries now start online (web forms, portals), with telehealth and online course signups pushing numbers higher in urban areas.

-

Local Services (repair, salons, trades) — ~15–35% online, rising quickly when businesses list on marketplaces and local search. In many developing markets a significant part of demand still begins offline but discovery via Google/Maps and websites is increasing.

4. Why the website matters in 2025 mechanisms and evidence

-

Discovery & trust: Consumers and businesses use search engines and company websites to evaluate credibility, read case studies, check pricing and contact vendors. HubSpot traffic and GoDaddy surveys show websites remain the primary discovery hub for SMEs.

-

Conversion funnel control: Websites let businesses capture leads (forms, chatbots), present tailored offers, and measure conversion rates essential for predictable marketing ROI. B2B marketing data show websites are top performing for lead capture when paired with content.

-

Channel economics: Owned digital channels (website + email + CRM) reduce customer acquisition cost compared with pure paid-only strategies. E-commerce growth and scale economies have made websites the lowest-cost conversion channel over time.

-

Mobile first behavior: A growing share of e-commerce and service searches happen on mobile so mobile-optimized websites and progressive web apps are critical. Mobile commerce share was approaching ~43% (2024) and projected to rise in 2025.

5. India specifics (2024–25)

-

Large user base: ICUBE/IAMAI data (2024) continues to show growth of active internet users in India (hundreds of millions), pushing more service searches online.

-

MSME digital gap: Government reports and MSME/industry studies find that while flagship, manufacturing and D2C firms are moving online rapidly, many traditional MSMEs still lag in full website adoption though digital engagement (WhatsApp, marketplaces) is rising.

-

Policy & programs: Central government and industry initiatives (digital MSME programs, payments infrastructure) in 2024–25 are boosting digital adoption meaning more Indian MSMEs will find websites and online channels necessary to scale.

6. Practical implications for businesses (what to prioritize in 2025)

For business owners and marketers practical checklist with rationale:

-

Own your funnel (website + CRM): Make your website the hub for discovery → qualification → conversion. Use forms, chat, bookings, and analytics. (Reason: cost control + measurable ROI).

-

Mobile-first UX & fast load times: With mobile commerce share rising, optimize speed, PWA/AMP and checkout flows.

-

SEO + content for B2B & local services: For IT/digital services, publish case studies, service pages and technical content these drive organic leads. Local citations and Google Business Profile for local services.

-

Integrate marketplaces thoughtfully: For MSMEs and retailers, marketplaces (and OTAs for travel) are growth accelerators but keep the website for higher margin direct sales.

-

Measure conversion KPIs: traffic → lead rate → MQL → SQL → revenue. Use those to plan paid spend and product/price testing. (HubSpot and B2B marketing guides show websites are primary for measurement).

7. Risks & challenges (2025)

-

Competition & discoverability: As more businesses go online, cost for paid channels rises. SEO and unique value differentiation become critical.

-

Operational readiness: Firms scaling online without operational capacity (fulfillment, service delivery) face poor customer experiences. MSME studies highlight this mismatch.

-

Regulatory & payments friction: Cross-border sales, data privacy rules, and payments/regulatory changes remain moving targets in 2024–25.

8. Methodology & sources

How this report was prepared: I synthesized recent industry surveys, research lab reports and authoritative studies published in 2024–2025 (GoDaddy research, HubSpot web reports, IAMAI/ICUBE India studies, KPMG India digital roadmap, MSME gov reports, industry e-commerce summaries, and market analysis sites). The main sources cited are below (representative list):

-

GoDaddy — Small Business Research Lab (Microbusiness Activity Index, 2024–2025).

-

HubSpot — web & marketing statistics and traffic reports (2024–2025).

-

IAMAI (ICUBE 2024) — India internet user data.

-

KPMG India — “India’s digital dividend” / digital roadmap 2025 (pdf).

-

Red Stag Fulfillment / industry summaries — global ecommerce share 2024.

-

Sellers Commerce / Invesp CRO — e-commerce revenue and mobile commerce trends (2024–2025).

-

ICRIER & MSME-related surveys — MSME digitalization studies (2024–2025).

-

Industry marketing compilations (Demand Sage, Exploding Topics) for lead generation & B2B stats.

9. Recommendations (one-page action plan for businesses)

-

If you don’t have a website: build a simple, fast, mobile-optimized site with clear contact/booking forms and basic SEO.

-

If you have a basic site: improve product/service pages, add case studies/testimonials, add conversion tracking and a CRM.

-

If you sell online: adopt mobile-first checkout, test marketplaces vs direct site promotions, and reduce friction in payments/shipping.

-

SMEs in India: prioritize Google Business Profile, WhatsApp business integration, and low-cost lead capture while planning for phased web upgrades.

10. Appendix quick stats you can copy

-

Global e-commerce share of retail (2024): ≈20.1%.

-

Projected global e-commerce sales (2025): ~$6.8T.

-

B2B lead generation: websites + content = core lead source for most B2B marketers in 2024–25.

-

India active internet users (ICUBE 2024): large and growing base (foundation for online services).

-

MSME digital engagement indicator: ~30–40% digital customer engagement in many MSME studies, with sector variation.